Mergers and acquisitions (M&A) are pivotal moments in the lifecycle of any organization. When executed well, they can create significant value, foster innovation, and accelerate growth. However, the integration process is often fraught with challenges, particularly in the area of organization design. Understanding and effectively managing these challenges is critical for business leaders, CHROs, organization design professionals, and M&A teams.

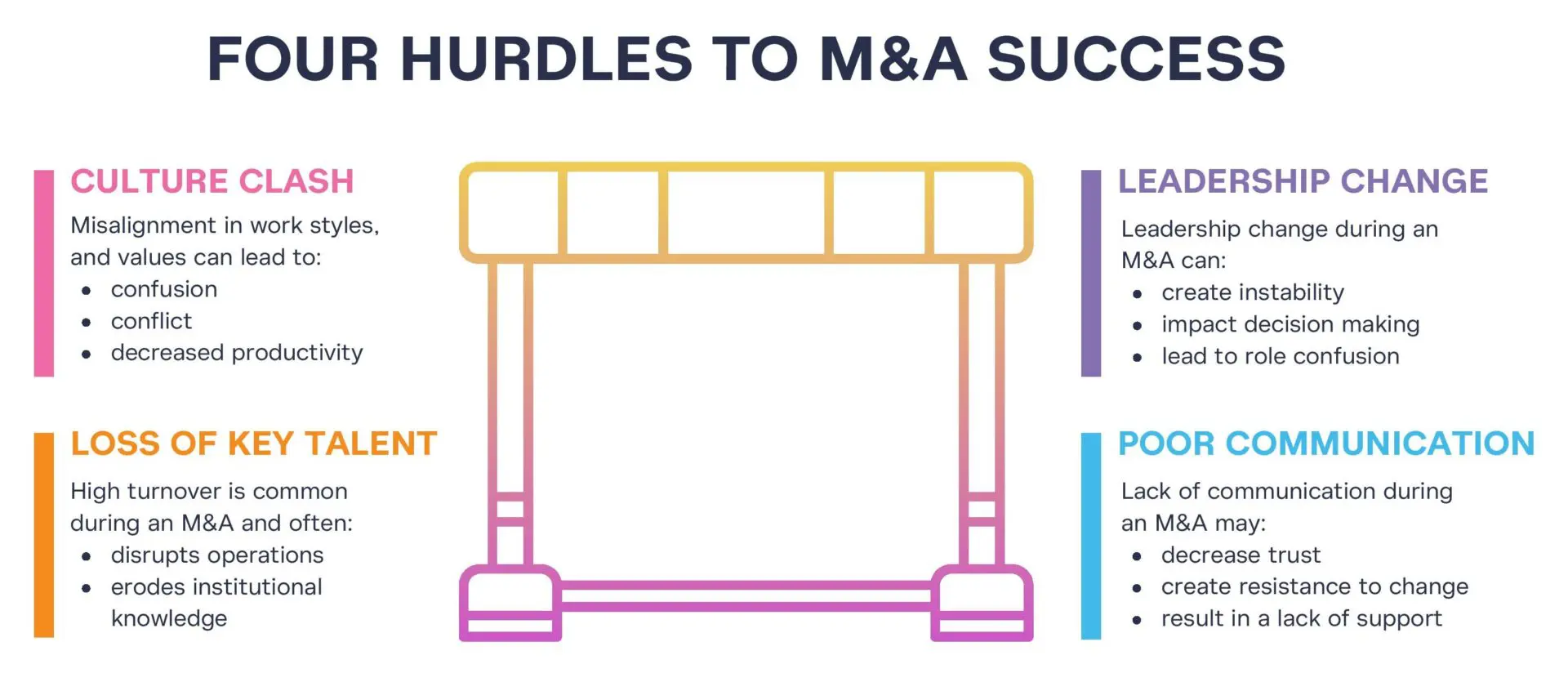

In this blog post, we delve into the key considerations for organization design during M&A. We will explore common hurdles such as culture clash, talent retention, new leaderships structures, and communication. By addressing these areas thoughtfully, you can steer your organization toward a successful integration and unlock the full potential of your M&A.

Culture Clash

Identifying Cultural Differences

Every organization has its own unique culture, shaped by its history, values, and people. When two companies merge, these cultural differences can create significant obstacles. Misalignment in work styles, communication patterns, and corporate values can lead to confusion, conflict, and decreased productivity.

Creating a Plan for Cultural Integration

Business leaders need to proactively identify cultural differences and develop a comprehensive integration plan. This involves:

- Conducting Cultural Assessments: Evaluate the existing cultures of both organizations to highlight areas of convergence and divergence.

- Engaging Employees: Involve employees at all levels in discussions about culture to gather insights and foster buy-in for the integration process.

- Defining a New Culture: Develop a vision for the new organizational culture that aligns with the strategic goals of the combined entity.

- Implementing Change Management Initiatives: Use training programs, workshops, and team-building activities to support cultural integration.

Talent Retention

The Importance of Retaining Key Talent

One of the biggest risks during M&A is the loss of key talent. High turnover can disrupt operations, erode institutional knowledge, and hinder the realization of strategic objectives. Retaining top performers is crucial for maintaining continuity and achieving long-term success.

Strategies for Talent Retention

To retain key talent during M&A, consider the following strategies:

- Communicate Clearly and Frequently: Keep employees informed about the M&A process, its impact on their roles, and the opportunities available in the new organization.

- Recognize and Reward Performance: Implement retention bonuses, promotions, and other incentives to acknowledge and reward top performers.

- Offer Career Development Opportunities: Provide clear career paths and professional development programs to help employees envision a future within the new organization.

- Address Concerns and Uncertainties: Be responsive to employee concerns and provide support through counseling, mentorship, and open forums for discussion.

Leadership & Decision-Making

Planning the New Leadership Structure

M&A deals often result in changes to the leadership structure, which can create instability and affect decision-making. It is essential to carefully plan the new leadership framework to ensure alignment with the strategic direction of the newly combined companies.

Key Considerations for Leadership and Decision-Making

When designing the new leadership structure, consider the following:

- Define Clear Roles and Responsibilities: Establish a clear hierarchy and delineate roles to avoid confusion and overlap.

- Align Leadership with Strategic Goals: Select leaders whose skills, experience, and vision align with the strategic objectives of the combined entity.

- Promote Collaboration and Inclusivity: Foster a collaborative leadership style that encourages input from diverse perspectives and promotes inclusivity.

- Ensure Continuity: Retain key leaders from both organizations to maintain continuity and leverage their institutional knowledge.

Communication & Transparency

The Role of Communication in M&A

Effective communication is crucial during the organization design process in M&A. Transparent and consistent communication helps build trust, reduce resistance, and gain buy-in from stakeholders at all levels.

Best Practices for Communication and Transparency

To enhance communication and transparency, implement these best practices:

- Develop a Communication Plan: Outline key messages, target audiences, communication channels, and timelines to ensure a structured approach.

- Keep Stakeholders Informed: Regularly update stakeholders on the progress of the integration, the rationale behind decisions, and the expected outcomes.

- Address Concerns Promptly: Create channels for employees to voice their concerns and questions, and respond to them promptly and empathetically.

- Be Transparent About Changes: Clearly explain the changes being made, the reasons behind them, and how they will benefit the organization in the long run.

Smart Organization Design in M&A: Critical for Success

Designing an organization during M&A is a complex and challenging endeavor. By focusing on the key areas we’ve covered here, business leaders and M&A teams can navigate the integration process more effectively.

These considerations are not just best practices—they are essential elements for achieving a successful merger or acquisition. When handled correctly, they can transform potential obstacles into opportunities for growth and innovation.

As you embark on your next M&A journey, remember that thoughtful organization design is not a one-time effort but an ongoing process. Stay committed to continuous improvement, remain adaptable, and keep the lines of communication open. Doing so will help you create a resilient, agile, and high-performing organization capable of thriving in an ever-changing business landscape.

For more insights and resources on organization design and M&A, stay connected with us. If you have any questions or need further assistance, feel free to reach out. Your success is our priority.